Financial market analysis: 2025: A year of uncertainty and opportunity

As 2025 unfolds, global markets face heightened volatility against a backdrop of unresolved challenges from 2024. Falling interest rates, soaring equity markets, and escalating geopolitical tensions defined last year set the stage for pivotal shifts in the year ahead.

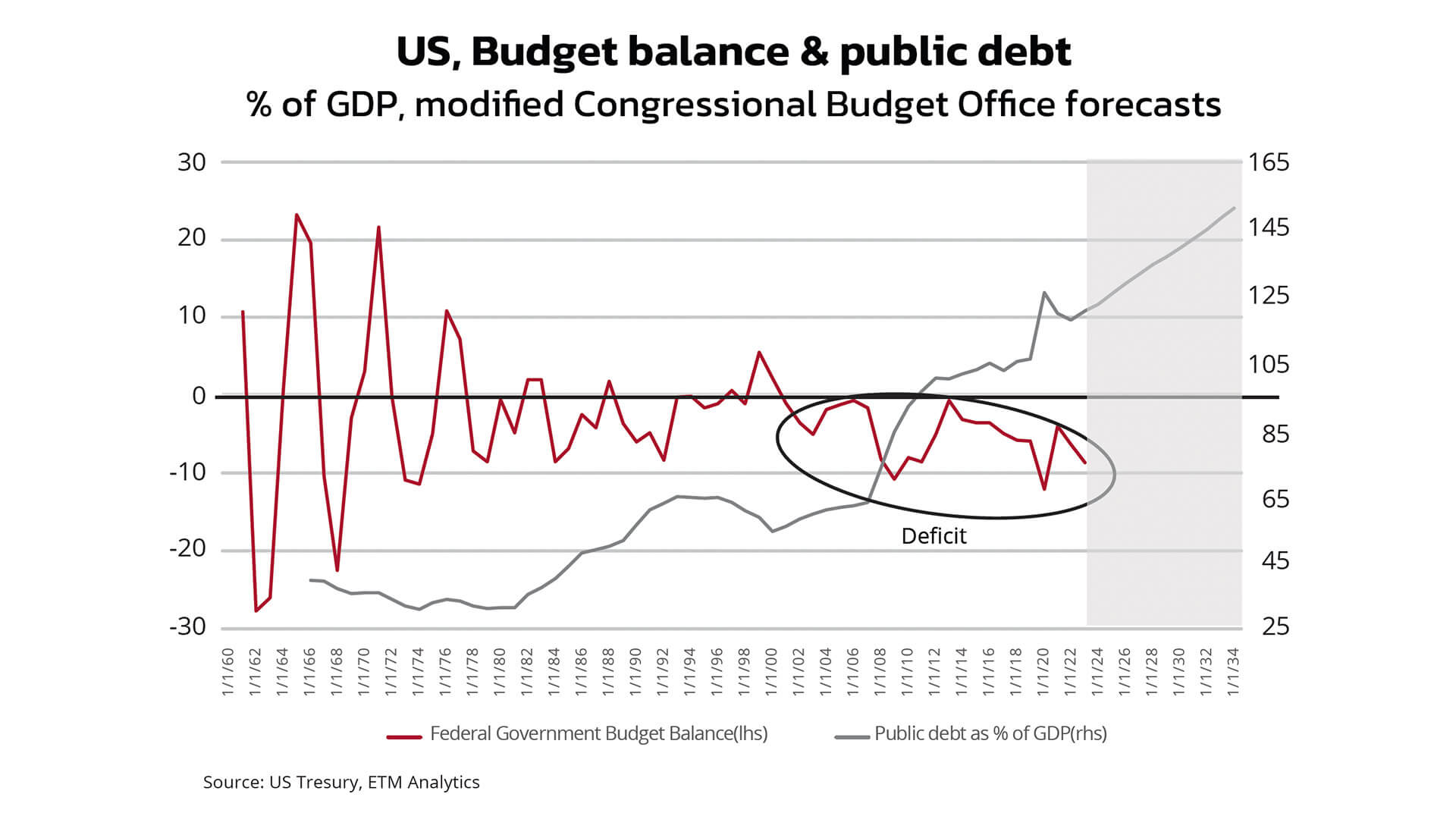

USA: Uncertainty Under Trump

Donald Trump's return to the White House raises questions about policy impacts. Promises of tariffs, tax cuts, and NATO withdrawal fuel market unease, while the ballooning US budget deficit is the most pressing challenge. Equity markets and the dollar remain buoyed by Republican optimism, but fiscal realities could soon weigh heavily.

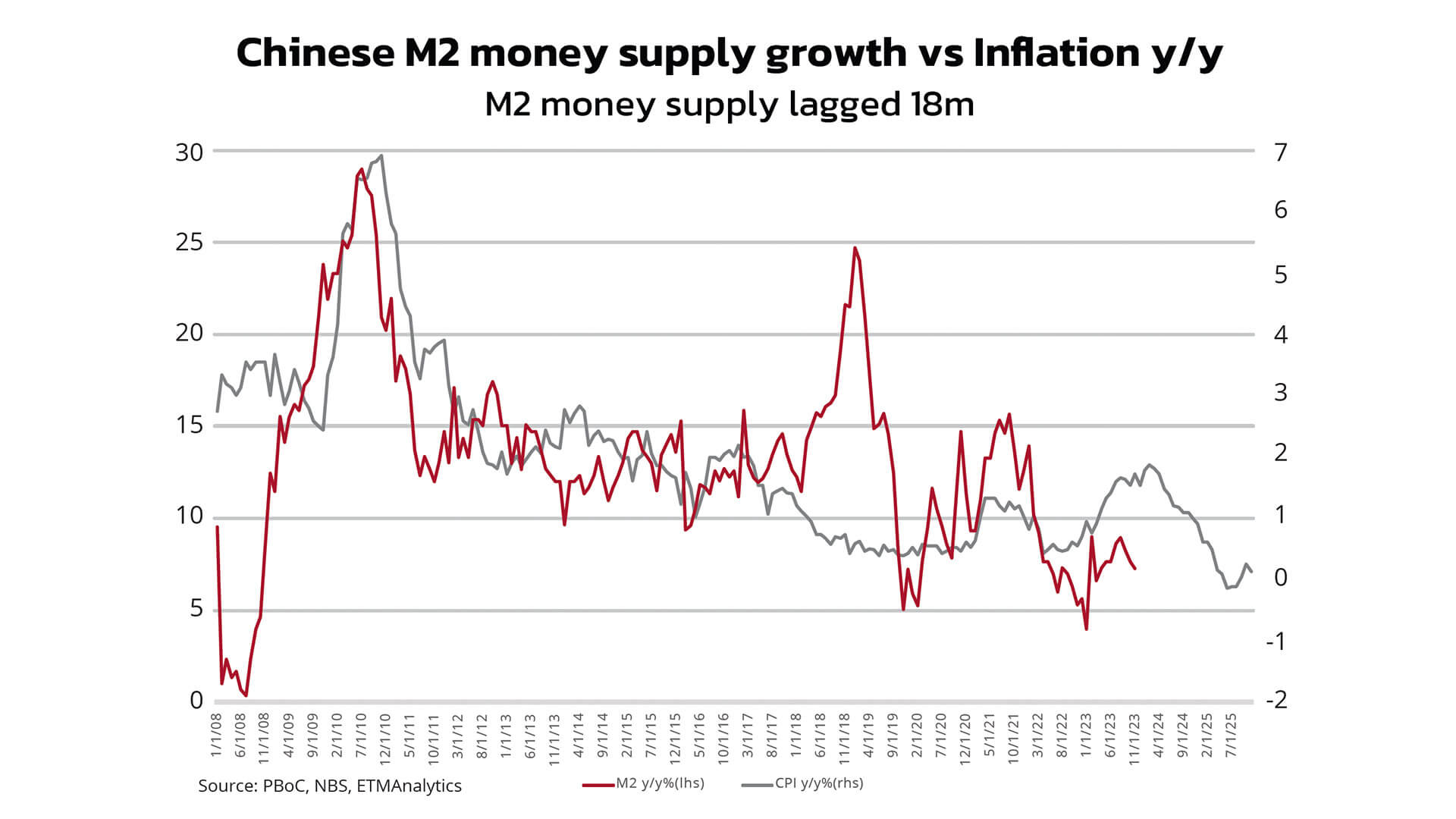

China: Balancing Growth and Deflation

China's sluggish export demand and faltering domestic consumption threaten its economic momentum. Stimulus measures highlight Beijing’s concerns, but the risk of a deflationary spiral grows. As trade tensions with the West escalate, China’s closer alignment with Russia signals a shared ambition to reshape global power dynamics.

Europe: Economic Survival

The EU continues to grapple with stagnation. Declining competitiveness, high energy costs, and political fragmentation hinder recovery despite easing inflation. Germany’s auto industry struggles, and France’s economy fares only slightly better. Political stability and strategic reassessment will be crucial to reviving key industries and navigating potential US tariffs under Trump.

Global Geopolitical Tensions

Conflict remains a significant driver of market movements. From the Middle East to Ukraine, unresolved disputes disrupt oil prices and safe-haven demand. While Trump vows swift resolutions, the broader struggle to reshape the global order persists, making lasting peace unlikely.

The risks to Africa

Africa may face economic challenges from a second Trump presidency and slowing Chinese growth. Higher global interest rates driven by Trump’s fiscal policies could worsen Africa's funding squeeze, raising borrowing costs and stifling investment. Meanwhile, reduced Chinese demand could lower commodity prices, straining export revenues and fiscal positions. The threat of more protectionist policies under Trump looms for the continent, but ultimately, US consumers could bear the brunt of increased costs associated with these policies.

Looking Ahead

Investors must brace for turbulence as shifting monetary policies, geopolitical conflicts, and uncertain leadership transitions dominate 2025. Opportunities will arise, but navigating the year will require caution, adaptability, and a close eye on emerging risks.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partners, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.