Financial Market Analysis: Trump’s Policies and the Looming Financial Strain on Africa

President Donald Trump has entered into his second presidency with a firm ideological stance, which is strongly nationalist and firmly in the camp of American interests first. Global financial markets have experienced volatility with his tariff narrative already hitting a number of countries, most specifically the US’s neighbours of Mexico and Canada. Historically, Trump has seen Africa very much as secondary, with his policies overlooking the continent for the most part. During Trump 2.0 Africa may not be so lucky. Trump is all about trade and what he deems as advantageous for the United States. The African Growth Opportunity Act is something that may come under the spotlight, as have many aid projects which bring hard currency to the continent.

The first sign of things to come was the President halting for 90 days the U.S. President’s Emergency Plan for AIDS Relief (PEPFAR), a $7.5 billion program under the governance of the State Department and the partial waiver on the aid freeze which offers a potential reprieve to HIV/Aids programmes. There has been further confusion under what conditions certain programmes might still continue. Apart from the humanitarian crisis that might follow, it could contribute to a shortage of hard currency flowing into the continent exacerbating the broader dollar shortage felt in many African counties.

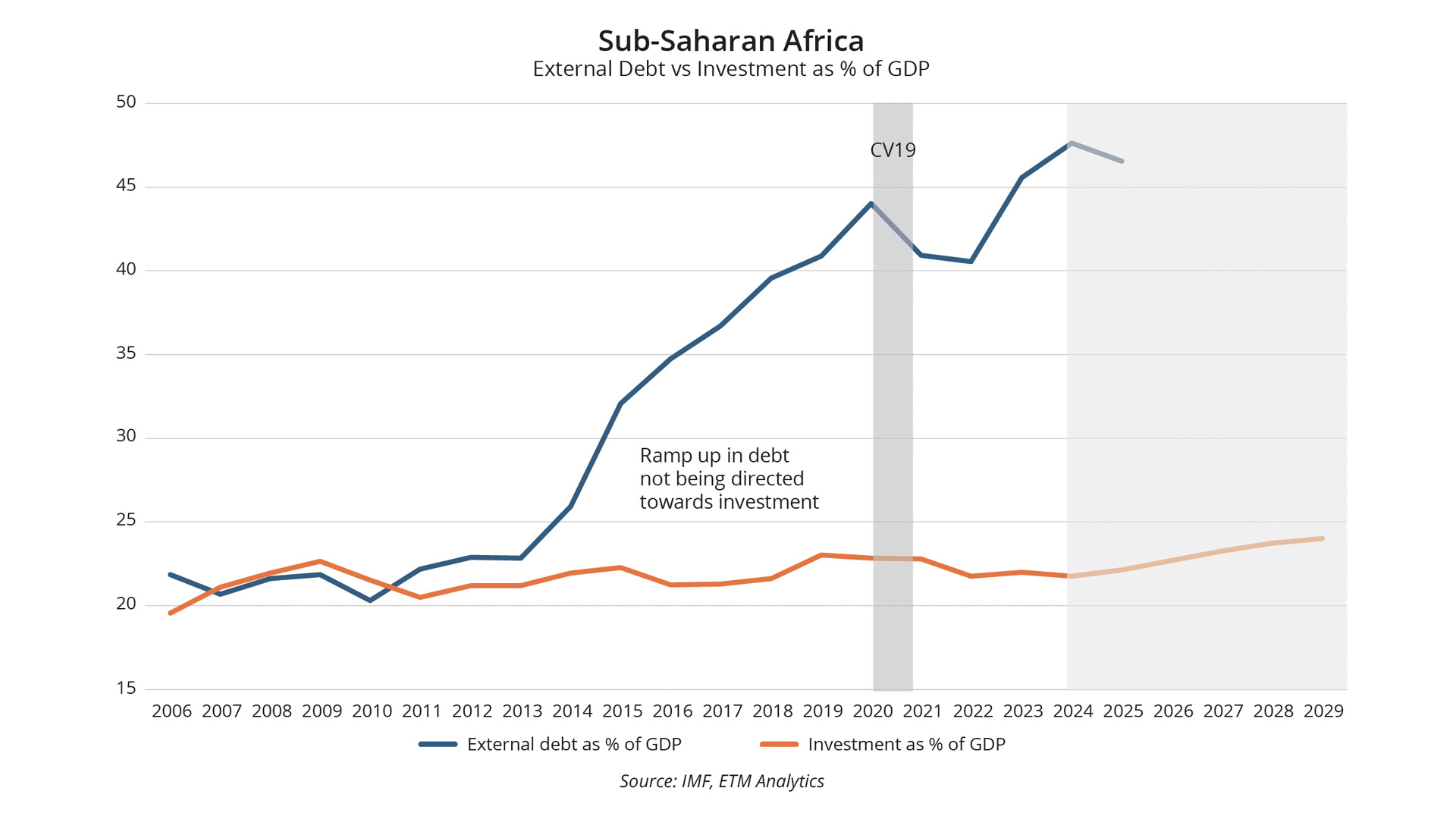

Trump’s policies might keep interest rates elevated if the tariffs levied prove inflationary. This contributes to higher borrowing costs for African nations. Consequently, countries already grappling with substantial sovereign debt may find themselves compelled to re-enter international capital markets under less favourable conditions, exacerbating existing financial strains.

Higher global interest rates have shut out African governments from the international capital markets since 2022 - when borrowing costs soared - creating a funding squeeze. While a handful of countries (Benin, Ivory Coast, Kenya, Cameroon, South Africa and Nigeria) returned to the Eurobond market last year, the fresh issuance has largely been borne out of necessity.

The potential return to more unorthodox policymaking under a second Trump administration suggests that using the Eurobond market for short-term funding shortfalls may turn challenging, complicating efforts for countries facing significant external debt repayments next year. Higher US interest rates and a stronger dollar will make it even more difficult to service existing debt and finance new projects. Nonetheless, the chart highlights how Sub-Saharan Africa redemptions are set to rise to $6bn this year from $5bn in 2024, which could compel sovereigns to return to international capital markets even though it will be costly.

The combination of elevated global rates and domestic tax revenue constraints in many African nations will push governments to increase borrowing in the local currency, driving up domestic yields and resulting in government debt crowding out private sector or corporate debt issuance which is never viewed in a positive light.

The global shift towards nationalism and away from globalisation, as evidenced by discussions at the World Economic Forum in Davos, suggests that African countries may need to seek alternative partnerships and strengthen regional cooperation to navigate the evolving economic landscape.

The return of Donald Trump to the U.S. presidency presents a complex array of economic challenges for African nations. Higher global interest rates, a strong U.S. dollar, shifts in trade policies and reduction in aid necessitate proactive fiscal strategies and regional collaboration to mitigate adverse impacts and ensure sustainable economic growth across the continent.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partners, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.